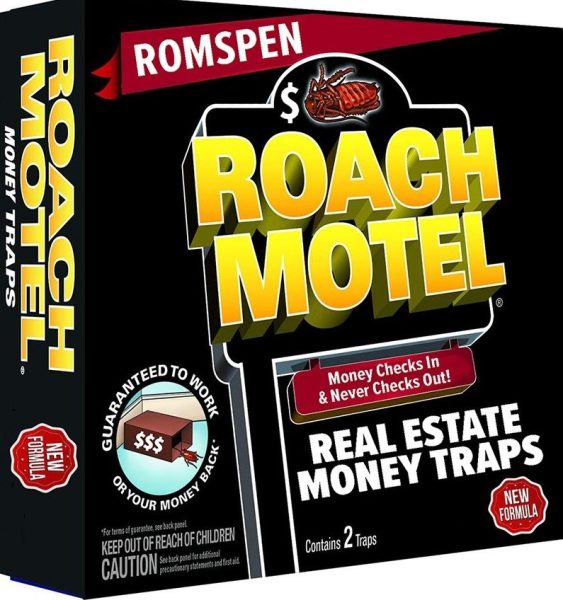

RomspenReport Has Obtained An Underwriting File Exposing Romspen Executives Lied To Investors About Multi-Million Dollar Romspen Mortgage Fraud Schemes

BCLP lawyer Christian Poland may have unintentionally opened a Pandora’s Box for his client, Romspen. The collapsing lender’s lawsuit against a former Miami blogger has exposed multiple Romspen mortgage fraud scheme. It’s a scheme that Romspen has spent millions of dollars trying to hide from regulators and the public.

Their lawyer, Christian Poland has also conspired to with them to have it suppressed. That’s how damning the file is.

Christian Poland is an evangelical Christian who claims to be follower of Jesus’ teachings. Yet, he isn’t afraid to lie and use unethical tactics right out from scumbag lawyer Roy Cohn’s playbook. Tactics that Cohn’s own rabbi condemned. In other words, he’s a typical evangelical Christian hypocrite.

Cohn used to silence his opposition by employing questionable and abusive litigation practices. Yes, Romspen’s Chicago fixer Christian Poland is employs the same tactics.

Romspen executives and Christian Poland always try to tighten their grip on their critics. However, the more they do, the more damaging information slips their fingers.

That is exactly what happened over the past few month.

Romspen Mortgage Fraud Scheme Exposed By Former Miami Blogger

In June 2022, MFI-Miami blogger Steve Dibert began writing articles questioning Romspen’s odd lending practices. On the surface, these lending practices look like just poor underwriting and deal making.

In June 2022, MFI-Miami blogger Steve Dibert began writing articles questioning Romspen’s odd lending practices. On the surface, these lending practices look like just poor underwriting and deal making.

However, when Dibert dug deeper it, a pattern developed. It became clear Romspen was operating a major toxic Loan-To-Own mortgage scheme.

A Loan-To-Scheme is exactly what Romspen pulled on Caroline Weiss in Miami. They lent the mentally ill octogenarian with no commercial development experience $21.3 million in 2020. In addition, Weiss’s estranged daughter was also suing her for real estate fraud. Yet, Romspen claims publicly and under oath, they knew none of this. However, recent court filings suggest other wise. They show Romspen Director Mark Hillson, Wesley Roitman and Blake Cassidy signed off on the deal that set Caroline Weiss up to fail.

Romsen also committed more heinous acts with a deal than scamming a senile old woman. They also misled their investors. We know this because we now have the proof. What’s more disturbing is a self-proclaimed pious attorney like Christian Poland is helping Romspen cover up their crimes.

Romspen Files Highly Frivolous and Illegal SLAPP Lawsuit To Cover Up The Mortgage Fraud Scheme

In June 2023, Romspen brought a frivolous and illegal SLAPP lawsuit against MFI-Miami blogger Steve Dibert and MFI-Miami. They’re goal was to shut him up and they almost succeeded. Romspen attorney Christian Poland’s sexist and abusive behavior forced Dibert’s two female lawyers to quit. Dibert was then forced to represent himself as a pro-se litigant.

In June 2023, Romspen brought a frivolous and illegal SLAPP lawsuit against MFI-Miami blogger Steve Dibert and MFI-Miami. They’re goal was to shut him up and they almost succeeded. Romspen attorney Christian Poland’s sexist and abusive behavior forced Dibert’s two female lawyers to quit. Dibert was then forced to represent himself as a pro-se litigant.

Romspen and Poland had hoped this would force Dibert to default. Thus, they would win their lawsuit. Christian Poland dreamed of jumping up and down gleefully shouting, “I WON! I WON! I WON!”

What Poland thinks he’s actually going to “win” is anyone’s guess.

However, this is not how the case is playing out. The case has drawn out and Christian Poland’s legal career and reputation as an experienced federal litigator is in tatters.

The Nightmare Romspen Never Saw Coming

However, this case has turned into a nightmare for Romspen and their lawyers. Dibert has filed multiple bar complaints in Florida and Illinois against Poland for his conduct. The bar complaints led respected Chicago judge Jeffrey Cole to admonishing Poland for his boorish behavior.

However, this case has turned into a nightmare for Romspen and their lawyers. Dibert has filed multiple bar complaints in Florida and Illinois against Poland for his conduct. The bar complaints led respected Chicago judge Jeffrey Cole to admonishing Poland for his boorish behavior.

Of course, Poland’s once stellar legal career is permanently destroyed. He can jump up and down. He can threaten Dibert and other people. However, at the end of the day there is nothing he can do about it.

On May 23rd, Dibert filed a Motion for Summary Judgment against Romspen. The federal court shot down Dibert’s motion because he filed it after the deadline. However, Dibert filed Romspen’s underwriting file for Weiss loan as an exhibit.

On May 29th, Romspen’s Luciferian lawyer Poland bitched to the court. Poland claimed the file was marked “confidential” and could not be submitted as evidence.

As a result, Magistrate Judge Bruce Reinhart agreed and ordered the evidence sealed.

You may remember Reinhart. He signed the search warrant for the FBI to raid Mar-A-Lago in 2022. Naturally, the raid and the legal proceedings against President Trump that followed turned into national embarrassment.

Anyway, back to Dibert and Romspen. Dibert’s filing and it’s exihibits were publicly available for 6 days. The RomspenReport‘s crack team of eagle eyed observers downloaded a copy of it before it was re-sealed. The file also shows Dibert was right about Romspen’s Loan-To-Own scheme. It also shows Romspen executives lied to their investors about the file. The file clearly shows that Romspen executives knew Caroline Weiss did not even remotely qualify for a $21.3 million loan. Yet, they gave it to her anyway. Read the file for yourself.

Here Are Some Of The Disturbing Highlights Romspen Is Trying To Hide:

1. Did Romspen Lie To Investors About Caroline Weiss’s Experience As A Developer?

Romspen states in the underwriting file that Caroline Weiss had formed her “Weiss Group of Companies” in 1969. However, the Florida Secretary of State says Weiss didn’t incorporate the company until February 2017. Yes, this is 26 months after her daughter sued her for fraud. It is basic underwriting 101. Where did Romspen get their information? Did they make up the date and lie to investors? It appears they may have.

2. Caroline Weiss Refused To Supply A List Of Her Assets

Romspen’s own underwriting file states that Caroline Weiss refused to supply Romspen any type of list showing her assets. The underwriting file states:

“Notwithstanding various requests, we have been unable to validate the Guarantor’s net worth statement.”

This is like a big red flag to underwriters. Underwriters will usually deny a commercial loan if the applicant refuses to supply this information. Namely, on $21 million commercial loans. Again, this is underwriting 101.

3. Romspen’s Underwriting File Shows Caroline Weiss’s Credit Report Was A Dumpster Fire

ROMSPEN’s underwriting file clearly shows Caroline Weiss’s credit score looked like Dresden at the end of World War II. She wouldn’t qualify for an FHA loan on her home let alone a $21.3 million commercial loan. The underwriting report states,

“Equifax report for Caroline Weiss dated January 22, 2020, reports score of 601 and an R9 payment to Citi.”

An R9 quote on a credit report indicates the worst possible credit rating for a revolving account. This signifies a bad debt or a collections. Romspen underwriters should know this.

4. The Romspen Underwriting File Acknowledges The Real Estate Fraud Case Against Caroline Weiss

The file also acknowledges what ROMSPEN executives were aware of the fraud lawsuit against Caroline Weiss and her properties. This contradicts their emails to investors denying any knowledge of the lawsuits.

The underwriting file states:

“There are two pending lawsuits relating to this property and the guarantor. One involves Caroline’s daughter Adeena and the second is the Blue Lagoon Condominium Association, which is the property located next door to the subject. The lawsuit commenced by her daughter Adeena is still before the courts and there is no time frame for resolution of same. There have been no discussions about the effect that future advances will be contingent on this lawsuit being dealt with.”

There is no dispute that this loan had serious issues. Issues that would cause vast majority of commercial lenders to run as far away from this loan as possible. Yet, Romspen managing partners, Wesley Roitman, Mark Hilson and Blake Cassidy all signed off on approving the loan.

Why? They were setting Caroline Weiss to fail like Romspen’s other Loan-To-Own scam victims.

However, the joke is now on Romspen. Romspen thought they were going to acquire a potential billion dollar project for pennies on the dollar. The case against Weiss has dragged out and has cost Romspen millions in legal fees. In addition, the North American commercial real estate market has tanked and it shows no sign of bouncing back. As a result, Romspen may acquiring three vacant lots in Miami worth only $3 million on a good day.

RomspenReport has acquired evidence of fraud in other Romspen deals. Guess what? We have proof they lied to investors on those too!

Check Out These Government Websites If You Feel You Are A Victim Of Romspen:

How To File A Complaint In Canada:

How To File A Complaint In Canada:

Contact The Canadian Investment Regulatory Organization (CIRO) At 1.877.442.4322 For More Information. You Can Also Email Them At complaints@mfda.ca

You Can Also Contact Your Local RCMP Office For Assistance By Clicking Here.

If That Doesn’t Work, Contact Finance Minister François-Philippe Champagne:

francois-philippe.champagne@parl.gc.ca

You Can Also Contact His Office On Parliament Hill At 613-995-4895 Or His Shawinigan, Quebec Office at 819-538-5291.

Call His Office At 613.992.2772 (Parliament Hill) or 613.692.3331.

If You Are An American Citizen. Contact These Federal Agencies:

You Can File A Complaint With The Securities And Exchange Commission By Clicking Here.

Also, You Can File A Complaint With The Federal Trade Commission By Clicking Here

In Addition, You Can File A Complaint With FINRA By Clicking Here

Also, Check Out These Other Articles About Romspen On RomspenReport.com:

Romspen Executives’ Secret Plan To Liquidate Loans For Pennies

Executives At Romspen Are Having A Meltdown

Romspen Attorney Kyle Hirsch Busted In Phony Credit Bid Scheme

CIBC Is Allegedly Planning To Sue Romspen For Fraud

Annual Romspen Investors Meeting Was An Absolute Crazy Train

RCMP Is Investigating Romspen Executives Over Fraud Claims

Peter Oelbaum: Is The Coked Out Executive Also A Sicko Pervert?

2025 Romspen Mortgage Investment Fund Annual Meeting

Romspen Executives Frequently Engage In Illicit Drug Use

Is Romspen Executive Wesley Roitman A Drug Addict?

Deadbeat Romspen Will Stiff Their Lawyers At BCLP

Wesley Roitman Looks Worried! Is He Going To Prison?

Wesley Roitman Admits Romspen Future Is Uncertain

Romspen Busted Conspiring With Disbarred Attorney Mark Stopa

Are Romspen Investor Fraud Victims Entitled To Compensation?

Romspen Fixer Christian Poland Faces Multiple Bar Complaints

Romspen Investment Corporation Reviews

Elderly Romspen Investors Forced To Eat Cat Food

Will Romspen Be Investigated By Florida OFR?

Agence du Revenu du Québec Raids Romspen Headquarters

Romspen Lawyers Are Stuck In The Mud In Multiple Lawsuits

Romspen Financial Colonoscopy: Is It Really Going To Happen?

The Deceptive Romspen Loan-To-Own Toxic Financing Scam

Romspen Is Scamming Grandma And Grandpa

Romspen Just Got Spanked By The Florida 3rd DCA

Will A Romspen Super Lawyer Cost Romspen $21 Million?

Romspen Gave 3 Stoners $54 Million

Toronto-Based Romspen Threw In The Towel On Uphill Foreclosure Fight

Romspen Investors Are Mad As Hell And Want Their Money

Canadian Commercial Lender Romspen Withholds Partial Redemption Payments

Toronto Based Romspen Investment Corp. Sues Fake Real Estate Tycoon